Page 12 - Profmark Tax Guide 2025

P. 12

DEDUCTIONS

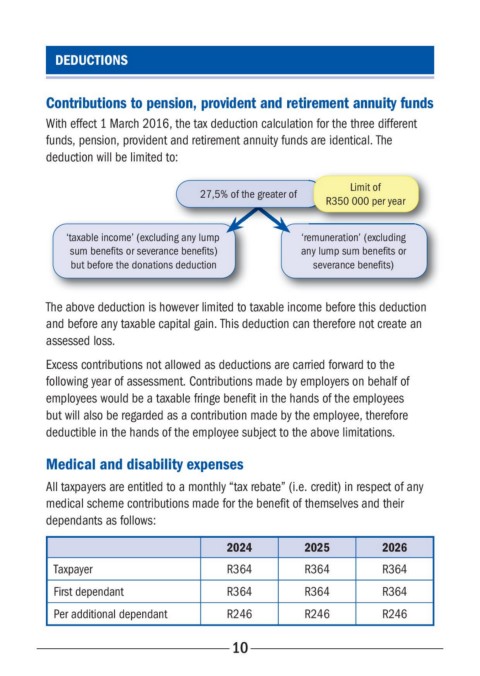

Contributions to pension, provident and retirement annuity funds

With effect 1 March 2016, the tax deduction calculation for the three different

funds, pension, provident and retirement annuity funds are identical� The

deduction will be limited to:

Limit of

27,5% of the greater of

R350 000 per year

‘taxable income’ (excluding any lump ‘remuneration’ (excluding

sum benefits or severance benefits) any lump sum benefits or

but before the donations deduction severance benefits)

The above deduction is however limited to taxable income before this deduction

and before any taxable capital gain� This deduction can therefore not create an

assessed loss�

Excess contributions not allowed as deductions are carried forward to the

following year of assessment� Contributions made by employers on behalf of

employees would be a taxable fringe benefit in the hands of the employees

but will also be regarded as a contribution made by the employee, therefore

deductible in the hands of the employee subject to the above limitations�

Medical and disability expenses

All taxpayers are entitled to a monthly “tax rebate” (i�e� credit) in respect of any

medical scheme contributions made for the benefit of themselves and their

dependants as follows:

2024 2025 2026

Taxpayer R364 R364 R364

First dependant R364 R364 R364

Per additional dependant R246 R246 R246

10