Page 37 - Profmark_2024_Directors Guide

P. 37

The Amendment Act clears up the previously confusing wording of this section, and

states the particulars applicable to remuneration should apply to prescribed officers as

well, and that it will be a requirement that each individual is named. In addition, the

insertion of Section 30A provides that, in line with King IV ™, public and state-owned

companies are required to prepare and present a remuneration policy with details of the

remuneration and benefits awarded to individual directors and prescribed officers – for

approval by the shareholders by ordinary resolution, at the AGM. The remuneration policy

must be presented thereafter for approval by ordinary resolution at the AGM and every

three years or whenever any material change to the remuneration policy is made. The

amendment sets out what must be included in the remuneration report – which would

include a background statement, the remuneration policy, an implementation report,

as well as the gap between their highest paid and lowest paid employees, the average

remuneration of all employees etc. This report must be approved by the board and

presented to the shareholders at the AGM and voted by the shareholders for approval.

The implementation report and the remuneration policy shall be construed as separate

documents with separate voting requirements which shall be approved by ordinary

resolution.

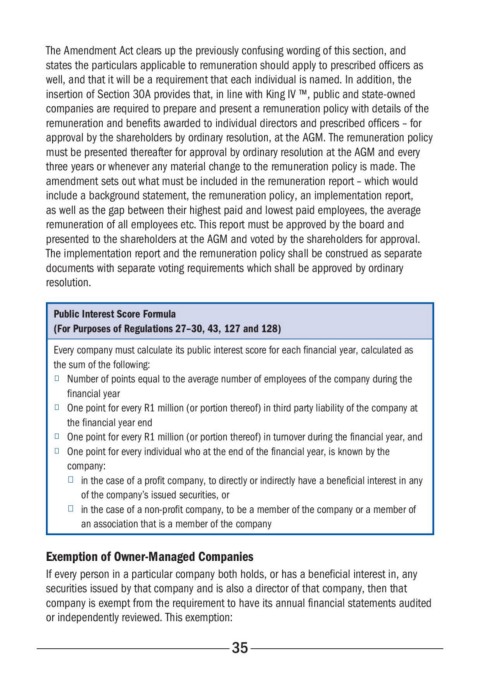

Public Interest Score Formula

(For Purposes of Regulations 27–30, 43, 127 and 128)

Every company must calculate its public interest score for each financial year, calculated as

the sum of the following:

■ Number of points equal to the average number of employees of the company during the

financial year

■ One point for every R1 million (or portion thereof) in third party liability of the company at

the financial year end

■ One point for every R1 million (or portion thereof) in turnover during the financial year, and

■ One point for every individual who at the end of the financial year, is known by the

company:

■ in the case of a profit company, to directly or indirectly have a beneficial interest in any

of the company’s issued securities, or

■ in the case of a non-profit company, to be a member of the company or a member of

an association that is a member of the company

Exemption of Owner-Managed Companies

If every person in a particular company both holds, or has a beneficial interest in, any

securities issued by that company and is also a director of that company, then that

company is exempt from the requirement to have its annual financial statements audited

or independently reviewed. This exemption:

35