Page 52 - Profmark Tax Guide 2025

P. 52

LEARNERSHIP ALLOWANCES

An annual and completion allowance of R40 000 may be claimed by the taxpayer

for learnerships NQF qualifications from levels 1 to 6, and R20 000 for learnerships

NQF qualifications from levels 7 to 10. The deduction claimable for disabled

learners is R60 000 or R50 000 for both annual and completion allowances.

Where a learnership is terminated before a period of 12 full months the employer

will be entitled to a pro rata portion of the annual allowance, regardless of the

reason for the termination of the learnership. The completion allowance for a

learnership of 24 months or more will be based on the number of consecutive

12 month periods completed × the above annual allowance amount.

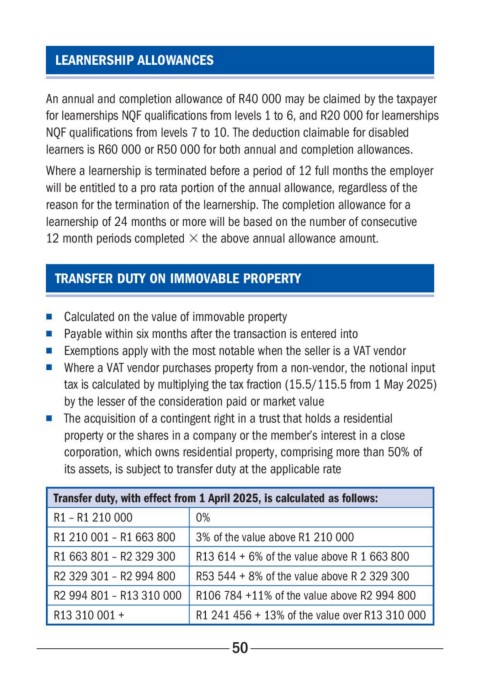

TRANSFER DUTY ON IMMOVABLE PROPERTY

■ Calculated on the value of immovable property

■ Payable within six months after the transaction is entered into

■ Exemptions apply with the most notable when the seller is a VAT vendor

■ Where a VAT vendor purchases property from a non-vendor, the notional

input tax is calculated by multiplying the tax fraction (15/115) by the lesser

of the consideration paid or market value

■ The acquisition of a contingent right in a trust that holds a residential

property or the shares in a company or the member’s interest in a close

corporation, which owns residential property, comprising more than 50% of

its assets, is subject to transfer duty at the applicable rate

Transfer duty, with effect from 1 April 2025, is calculated as follows:

R1 – R1 210 000 0%

R1 210 001 – R1 663 800 3% of the value above R1 210 000

R1 663 801 – R2 329 300 R13 614 + 6% of the value above R 1 663 800

R2 329 301 – R2 994 800 R53 544 + 8% of the value above R 2 329 300

R2 994 801 – R13 310 000 R106 784 +11% of the value above R2 994 800

R13 310 001 + R1 241 456 + 13% of the value over R13 310 000

50