Page 34 - Profmark BSA Guide 2025

P. 34

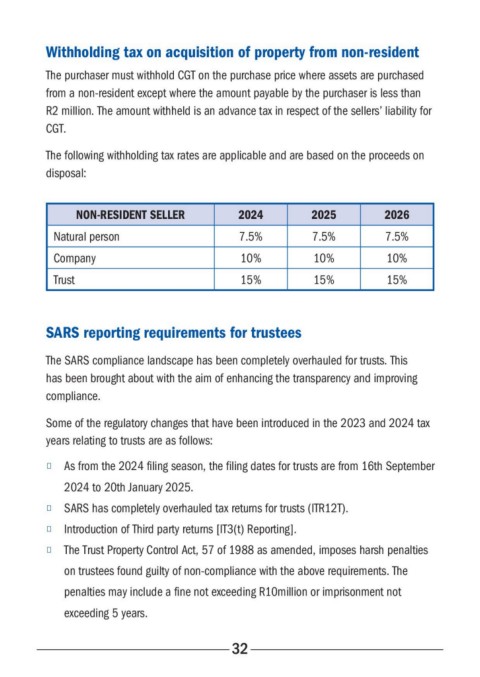

Withholding tax on acquisition of property from non-resident

The purchaser must withhold CGT on the purchase price where assets are purchased

from a non-resident except where the amount payable by the purchaser is less than

R2 million. The amount withheld is an advance tax in respect of the sellers’ liability for

CGT.

The following withholding tax rates are applicable and are based on the proceeds on

disposal:

NON-RESIDENT SELLER 2024 2025 2026

Natural person 7.5% 7.5% 7.5%

Company 10% 10% 10%

Trust 15% 15% 15%

SARS reporting requirements for trustees

The SARS compliance landscape has been completely overhauled for trusts. This

has been brought about with the aim of enhancing the transparency and improving

compliance.

Some of the regulatory changes that have been introduced in the 2023 and 2024 tax

years relating to trusts are as follows:

■ As from the 2024 filing season, the filing dates for trusts are from 16th September

2024 to 20th January 2025.

■ SARS has completely overhauled tax returns for trusts (ITR12T).

■ Introduction of Third party returns [IT3(t) Reporting].

■ The Trust Property Control Act, 57 of 1988 as amended, imposes harsh penalties

on trustees found guilty of non-compliance with the above requirements. The

penalties may include a fine not exceeding R10million or imprisonment not

exceeding 5 years.

32