Page 22 - Profmark Tax Guide 2025

P. 22

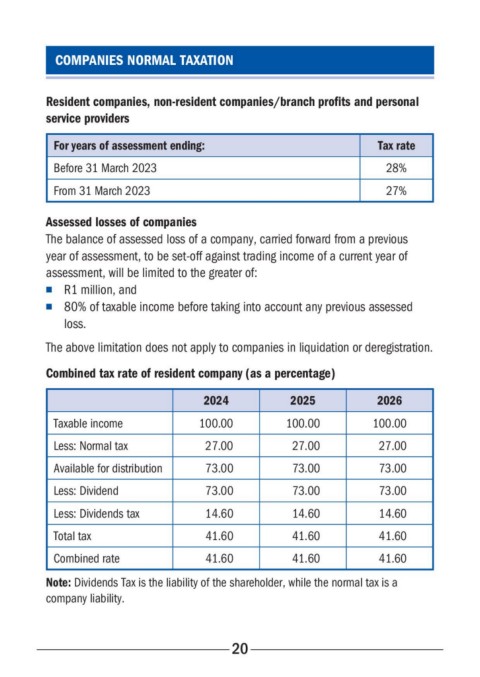

COMPANIES NORMAL TAXATION

Resident companies, non-resident companies/branch profits and personal

service providers

For years of assessment ending: Tax rate

Before 31 March 2023 28%

From 31 March 2023 27%

Assessed losses of companies

The balance of assessed loss of a company, carried forward from a previous

year of assessment, to be set-off against trading income of a current year of

assessment, will be limited to the greater of:

■ R1 million, and

■ 80% of taxable income before taking into account any previous assessed

loss�

The above limitation does not apply to companies in liquidation or deregistration�

Combined tax rate of resident company (as a percentage)

2024 2025 2026

Taxable income 100�00 100�00 100�00

Less: Normal tax 27�00 27�00 27�00

Available for distribution 73�00 73�00 73�00

Less: Dividend 73�00 73�00 73�00

Less: Dividends tax 14�60 14�60 14�60

Total tax 41�60 41�60 41�60

Combined rate 41�60 41�60 41�60

Note: Dividends Tax is the liability of the shareholder, while the normal tax is a

company liability�

20