Page 8 - Profmark Africa Overview 2024

P. 8

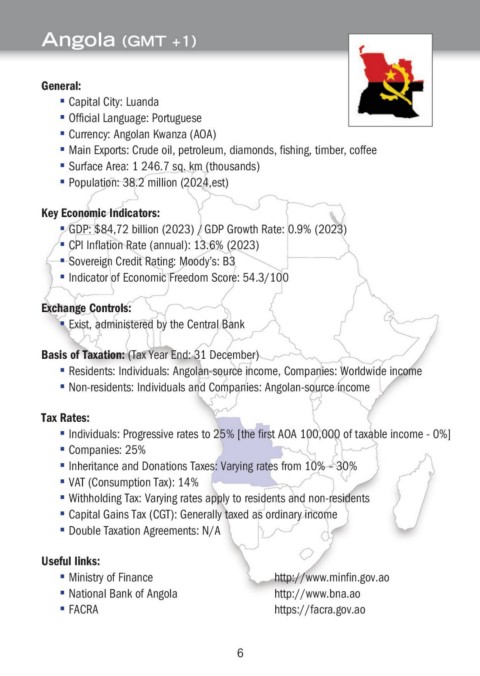

Angola (GMT +1)

General:

▪ Capital City: Luanda

▪ Official Language: Portuguese

▪ Currency: Angolan Kwanza (AOA)

▪ Main Exports: Crude oil, petroleum, diamonds, fishing, timber, coffee

▪ Surface Area: 1 246.7 sq. km (thousands)

▪ Population: 38.2 million (2024,est)

Key Economic Indicators:

▪ GDP: $84,72 billion (2023) / GDP Growth Rate: 0.9% (2023)

▪ CPI Inflation Rate (annual): 13.6% (2023)

▪ Sovereign Credit Rating: Moody’s: B3

▪ Indicator of Economic Freedom Score: 54.3/100

Exchange Controls:

▪ Exist, administered by the Central Bank

Basis of Taxation: (Tax Year End: 31 December)

▪ Residents: Individuals: Angolan-source income, Companies: Worldwide income

▪ Non-residents: Individuals and Companies: Angolan-source income

Tax Rates:

▪ Individuals: Progressive rates to 25% [the first AOA 100,000 of taxable income - 0%]

▪ Companies: 25%

▪ Inheritance and Donations Taxes: Varying rates from 10% – 30%

▪ VAT (Consumption Tax): 14%

▪ Withholding Tax: Varying rates apply to residents and non-residents

▪ Capital Gains Tax (CGT): Generally taxed as ordinary income

▪ Double Taxation Agreements: N/A

Useful links:

▪ Ministry of Finance http://www.minfin.gov.ao

▪ National Bank of Angola http://www.bna.ao

▪ FACRA https://facra.gov.ao

6 7