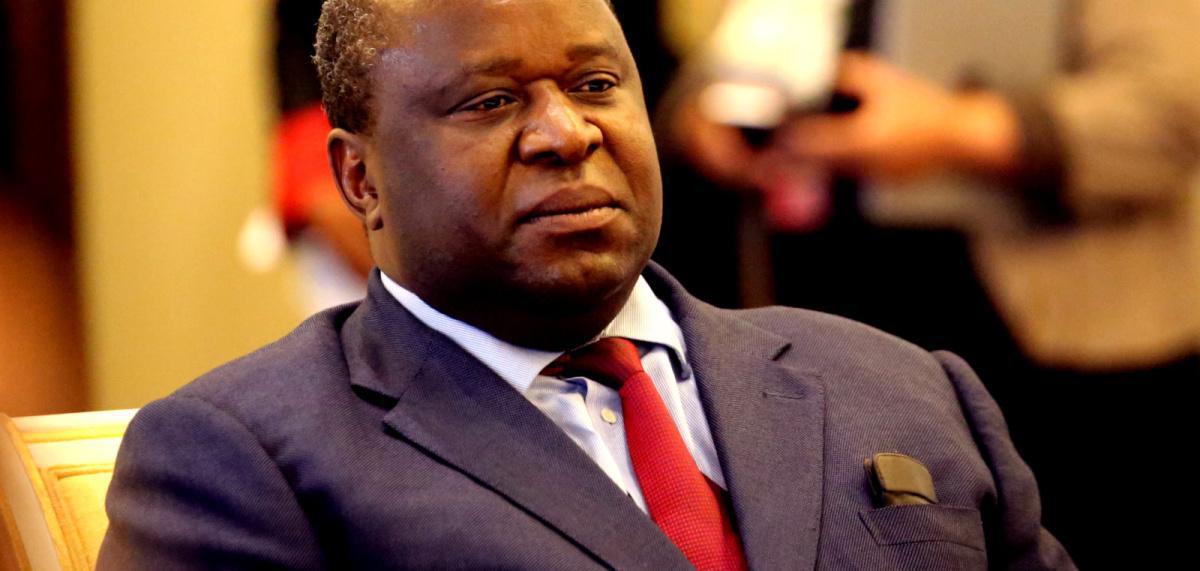

“I can promise my new colleagues in the National Treasury that

much more hard work lies ahead for all of us

in the interests of our country”

TT Mboweni

The quote above from Tito Mboweni pretty much sums up the MTBPS. Since the last budget speech, our economic forecasts have had to be revised given the technical recession. The key central challenges remain in raising economic growth and reducing unemployment.

Over the period ahead, government is focusing on reforms that support economic growth, reduce inflationary pressures and improve service delivery. Fiscal options have become increasingly limited, and higher revenues need to flow from a broad-based economic expansion.

Accordingly, this MTBPS prioritises three interlinked policy areas:

- Implementing the President’s economic stimulus and recovery plan, particularly by encouraging private-sector investment.

- Improving governance and financial management in national, provincial and local government departments to support service delivery.

- Reforming state-owned companies. Improving the financial health of the major state-owned companies will take time, but measures are being taken to strengthen governance

Economic Overview

- GDP growth has been revised from 1.5 to 0.7 per cent in 2018 following a recession in the first half of the year. The economic outlook is weaker than projected in the 2018 Budget, although GDP growth is expected to recover gradually to 2.3 per cent by 2021 as confidence grows and investment gathers pace.

- The global economy is expected to continue growing at 3.7 per cent in 2018 and 2019. Global risks, however, are becoming more pronounced. Small and open developing economies, such as South Africa, are increasingly vulnerable to financial volatility and trade disruption.

- Government’s economic stimulus and recovery plan is intended to support a return to higher growth over the medium term. A combination of policy certainty, growth-enabling economic reforms, improved governance, and partnerships with business and labour will be key to restoring confidence and investment. Infrastructure spending will also support economic activity and job creation.

Fiscal Policy

- Government remains committed to sustainable public finances. Despite major spending pressures, the expenditure ceiling remains intact.

- Gross debt is projected to stabilise at 59.6 per cent of GDP in 2023/24. Currency depreciation accounts for about 70 per cent of the upward revision to gross loan debt in the current year.

- Tax revenue has been revised down by R27.4 billion in 2018/19, R24.7 billion in 2019/20 and R33 billion in 2020/21 relative to the 2018 Budget. This mainly reflects higher-than-expected VAT refunds.

- The consolidated budget deficit is estimated at 4 per cent in 2018/19, compared with the 2018 Budget projection of 3.6 per cent of GDP. After rising to 4.2 per cent, the deficit stabilises at 4 per cent in the outer year.

- Slow economic growth remains the primary risk to the framework. While some state-owned companies receive funding in the current year, their poor financial position could burden the public finances over the medium term.

Expenditure Priorities

- Government spending is expected to total R5.9 trillion over the medium-term expenditure framework (MTEF) period, growing at an annual average of 7.8 per cent per year.

- Funding remains focused on ensuring access to health and education, supporting low-income households through social grants, and providing basic services such as water and electricity.

- The expenditure ceiling remains unchanged from the 2018 Budget. Of the R32.4 billion of expenditure reprioritised over the medium term, R15.9 billion goes towards faster-spending infrastructure programmes, clothing and textile incentives, and job creation under the Expanded Public Works Programme.

- The public-service wage bill constitutes the largest share of government expenditure by economic classification, crowding out other spending. The wage agreement reached in 2018 adds to these pressures.

- National and provincial government will work with municipalities to improve governance and confront weaknesses in financial management.

VAT

The following items will be zero rated with effect from 1 April 2019:

- Sanitary pads

- Bread flour

- Cake flour

Carbon Tax

The carbon budgeting system and the carbon tax will be aligned. This is done by imposing a higher tax rate as a penalty for emissions exceeding the carbon budget. The original date of implementation of 1 January 2019 has been delayed till 1 June 2019.

Taxation Bills

The following Bills were tabled:

- Rates and Monetary Amounts and Amendment of Revenue Laws Act, 2018

- Taxation Laws Amendment Act, 2018

- Tax Administration Laws Amendment Bill

We have included these bills with the full MTBPS in the downloadable PDF below.